|

CONTACT: Jennifer Read September 6, 2022 FOR IMMEDIATE RELEASE

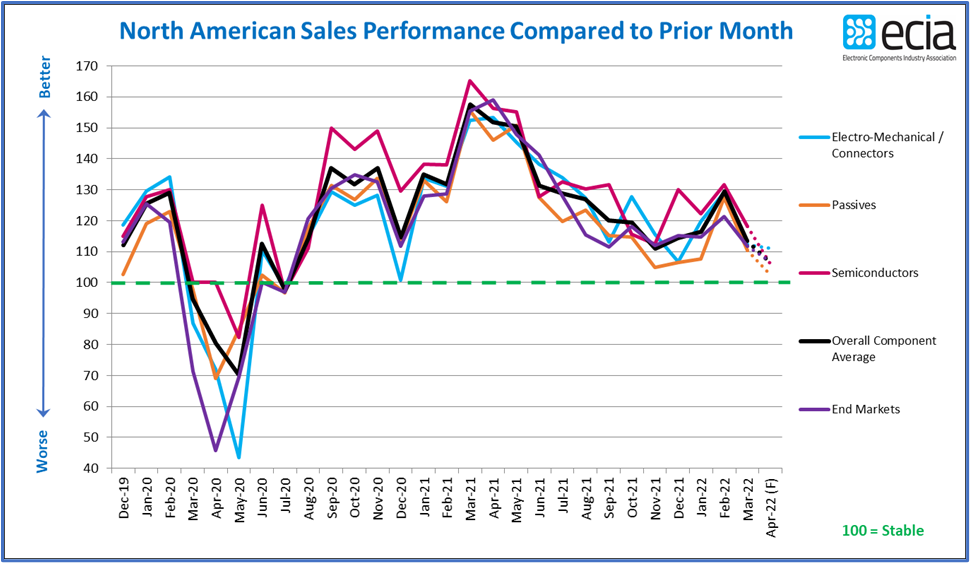

North America Electronic Component Sales Sentiment Plunges to Lowest Level Since COVID Collapse – More than Two Years

ATLANTA – ECIA has published the latest data from its Electronics Component Sales Trend survey (ECST). The indices from August 2022 and Q3 2022 reveal expectations that go from bad to worse as the industry moves through the 2nd half of 2022. The overall index average slumped from 94.7 in July to 86.0 in August. The one relatively bright spot is the expected stabilization of market sentiment in September as the outlook calls for a level of 88.4. Measurements below the benchmark level of 100 indicate negative sales growth. Expectations for the Semiconductor market split significantly from the other markets. The index for Semiconductors remained stable between July and August and shows a surprising jump to 100 for the September outlook. Passives show the weakest results as the index comes in below 78 for August. Expectations for Passives and Electro-Mechanical components in September are roughly equal, above 82. “Unfortunately, the picture from the quarterly perspective is even more bleak,” warned ECIA Chief Analysts Dale Ford, author of the report. “The overall share of those expecting market growth collapsed from 50% in Q2 2022 to 33% in Q3 followed by average expectations of growth reported by only 24% of participants. On the other side, the percentage expecting a declining market worsens from 32% in Q3 to 37% in Q4.”

The ECST survey provides highly valuable and detailed visibility on industry expectations in the near-term through the monthly and quarterly surveys. This ‘immediate’ perspective is helpful to participants up and down the electronics components supply chain. The complete ECIA Electronic Component Sales Trends (ECST) Report is delivered to all ECIA members as well as others who participate in the survey. All participants in the electronics component supply chain are invited and encouraged to participate in the report so they can see the highly valuable insights provided by the ECST report. The return on a small investment of time is enormous! The monthly and quarterly ECST reports present data in detailed tables and figures with multiple perspectives and covering current sales expectations, sales outlook, product cancellations, product decommits and product lead times. The data is presented at a detailed level for six major electronic component categories, six semiconductor subcategories and eight end markets. Also, survey results are segmented by aggregated responses from manufacturers, distributors, and manufacturer representatives. Read the summary report. About ECIA The Electronic Components Industry Association (ECIA) is made up of the leading electronic component manufacturers, their manufacturer representatives and authorized distributors. ECIA members share a common goal of promoting and improving the business environment for the authorized sale of electronic components. Comprised of a broad array of leaders and professionals representing all phases of the electronics components supply chain, ECIA is where business optimization, product authentication and industry advocacy come together. ECIA members develop industry guidelines and technical standards, as well as generate critical business intelligence. For more information, visit www.ecianow.org or call 678-393-9990. |